Concept explainers

Fixed

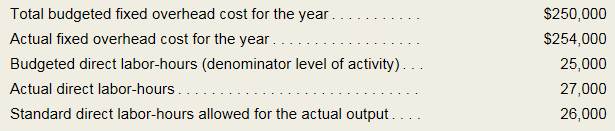

Primara Corporation has a

Required:

- Compute the fixed portion of the predetermined overhead rate for the year.

- Compute the fixed overhead

budget variance and volume variance.

1

Fixed portion of the predetermined overhead rate of the year.

Introduction: Fixed overhead volume variances mean a measure that defines the difference between budgeted fixed overhead costs and actual cost of fixed overhead costs. This explains the units produced based on the standard hours allowed and standard fixed rate.

Answer to Problem 10A.1E

Explanation of Solution

2

Fixed overhead budget variance and volume variance.

Introduction: Fixed overhead volume variances mean a measure that defines the difference between budgeted fixed overhead costs and actual cost of fixed overhead costs. This explains the units produced based on the standard hours allowed and standard fixed rate.

Answer to Problem 10A.1E

Budgeted variances is $4,000U and volume variances is $10,000F

Explanation of Solution

Want to see more full solutions like this?

Chapter 10A Solutions

MANAGERIAL ACCOUNTING F/MGRS.

- (Appendix) Calculating factory overhead: three variances Using the data given in E8-17, calculate the following overhead variances: a. Spending variance. b. Production-volume variance. c. Efficiency variance. d. Was the factory overhead under- or overapplied? By what amount? In all problems involving variances, use F and U to indicate favorable and unfavorable variances, respectively.arrow_forward(Appendix 10A) Which of the following is true concerning labor variances that are not material in amount? a. They are closed to Cost of Goods Sold. b. They are prorated among Work in Process, Finished Goods, and Cost of Goods Sold. c. They are prorated among Materials, Work in Process, Finished Goods, and Cost of Goods Sold. d. They are reported on the balance sheet at the end of the year. e. All of these.arrow_forwardIf variances are recorded in the accounts at the time the manufacturing costs are incurred, what does a debit balance in Direct Materials Price Variance represent?arrow_forward

- Variances Refer to Cornerstone Exercise 9.6. Required: 1. Calculate the variable overhead spending variance using the formula approach. (If you compute the actual variable overhead rate, carry your computations out to five significant digits and round the variance to the nearest dollar.) 2. Calculate the variable overhead efficiency variance using the formula approach. 3. Calculate the variable overhead spending variance and variable overhead efficiency variance using the three-pronged graphical approach. 4. What if 26,100 direct labor hours were actually worked in February? What impact would that have had on the variable overhead spending variance? On the variable overhead efficiency variance? Standish Company manufactures consumer products and provided the following information for the month of February: Required: 1. Calculate the fixed overhead spending variance using the formula approach. 2. Calculate the volume variance using the formula approach. 3. Calculate the fixed overhead spending variance and volume variance using the three-pronged graphical approach. 4. What if 129,600 units had actually been produced in February? What impact would that have had on the fixed overhead spending variance? On the volume variance?arrow_forwardBreakaway Companys labor information for May is as follows: A. What is the actual direct labor rate per hour? B. What is the standard direct labor rate per hour? C. What was the total standard direct labor cost for May? D. What was the direct labor rate variance for May?arrow_forwardIf variances are recorded in the accounts at the time the manufacturing costs are incurred, what does a debit balance in Direct Materials Price Variance represent?arrow_forward

- Assume that a company uses a standard cost system and applies overhead to production based on direct labor-hours. It provided the following information for its most recent year: Total budgeted fixed overhead cost for the year Actual fixed overhead cost for the year Budgeted direct labor-hours Actual direct labor-hours Standard direct labor-hours allowed for the actual output What is the fixed overhead volume variance? Multiple Choice O $20,000 U $20,000 F $9,000 U $9,000 F $ 300,000 $ 276,000 60,000 56,000 58, 200arrow_forwardRelations Among Fixed Overhead Variances Selected information relating to Yost Company’s operations for the most recent year is given below: The company applies overhead cost to products on the basis of standard machine-hours. Required: 1. What were the standard machine-hours allowed for the actual number of units produced? 2. What was the total budgeted fixed overhead cost for the period? 3. What was the fixed portion of the predetermined overhead rate. 4. What was the fixed overhead volume variance?arrow_forward3 What is the variable manufacturing overhead efficiency variance? Michelle Inc. uses a level 4 variance analysis of its manufacturing overhead costs and has the following results for April. A. Budgeted direct labour-hours per unit is used to allocate variable manufacturing overhead. Fixed overhead is allocated on a per unit basis. B. Budgeted amounts for April are: Direct labour-hours Variable labour-hour overhead rate Fixed manufacturing overhead Budgeted output (denominator level output) C. Actual amounts for April are: Variable manufacturing overhead Fixed manufacturing overhead Direct labour-hours Actual output A) $181,200 favourable B) $80,000 favourable C) $101,200 unfavourable. D) $84,000 unfavourable OE) $101,200 favourable 0.30/unit $20.00/DLH $630,000 30,000 units $340,000 $590,000 16,000 hours 40,000 unitsarrow_forward

- Primara Corporation has a standard costing system in which it applies overhead to products on the basis of the standard direct labour- hours allowed for the actual output of the period. Data concerning the most recent year appear below: Total budgeted fixed overhead cost for the year Actual fixed overhead cost for the year Budgeted standard direct labour-hours (denominator level of activity) Actual direct labour-hours Standard direct labour-hours allowed for the actual output $ 500,000 $ 508,000 50,000 54,000 52,000 Required: 1. Compute the fixed portion of the predetermined overhead rate for the year. Predetermined overhead rate per DLHarrow_forwardExercise 10A-1 (Algo) Fixed Overhead Variances [LO10-4] Primara Corporation applies overhead to products based on the standard direct labor-hours allowed for the actual output. Data concerning the most recent year appear below: Total budgeted fixed overhead cost for the year Actual fixed overhead cost for the year Budgeted direct labor-hours (denominator level of activity) Actual direct labor-hours Standard direct labor-hours allowed for the actual output Required: 1. Compute the fixed portion of the predetermined overhead rate for the year. Note: Round Fixed portion of the predetermined overhead rate to 2 decimal places. 1. Fixed portion of the predetermined overhead rate 2. Budget variance 2. Volume variance $ 476,000 $ 471,500 2. Compute the fixed overhead budget variance and volume variance. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance.). Input all amounts as positive values. per DLH…arrow_forwardDirect labor variances Bellingham Company produces a product that requires 3 standard direct labor hours per unit at a standard hourly rate of $22.00 per hour. 15,200 units used 65,200 hours at an hourly rate of $19.50 per hour. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. X Open spreadsheet What is the direct labor (a) rate variance, (b) time variance, and (c) cost variance? Round your answers to the nearest dollar. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. a. Direct labor rate variance b. Direct labor time variance c. Direct labor cost variancearrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning