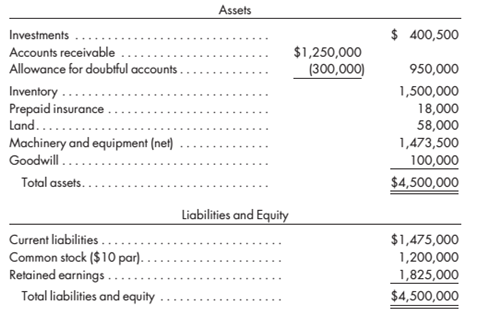

Jack Company is a Corporation that was organized on July 1, 2015. The June 30, 2020, balance sheet for Jack is as follows:

The experience of other corn panics over die last several years indicates that die machinery and equipment can be sold at 130% of its book value.

An analysis of the accounts receivable indicates that the realizable value is 5925.000. An independent appraisal made in June 2020 values the land at $70,000. Using the lower of-cost of or-market rule, inventory is to be restated at $1,200,000.

Callaway Corpora ion plans to exchange 18.000 of its shares for the 120.000 Jack shares.

During June 2020, the lair value of a share of always Corporation is $270. Equations costs are $12,000.

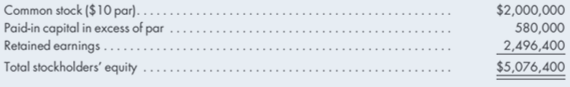

The stack holder’s equity account balances of always Corporation as of June 30. 2015, are as follows:

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

Advanced Accounting

- The current value or carrying value of Lance Engineering “cement mixer” was 2,550 in 2020. The company conducted a revaluation exercise in 2022. The carrying value of “the cement mixer was estimated to be $1000. The value of the “cement mixer” is deemed to be impaired. Select one: True False Irie Company prepares financial statements on a quarterly basis. The final set of financial statements prepared at the end of the financial year are presented to the auditor annually. The quarterly reports are referred to as Interim Financial Reports. Select one: True False The XR Company’s Financial Year Ended on December 31, 2021. However, before the completion of the audit in February 2023 it was determined the company lost a case that was at court before the end of the financial year, but the outcome was uncertain. The auditor will disclosed this information as: a. An annual expense b. An unusual occurrence c. A tax liability for the company d. A…arrow_forwardClarksville Printing Company sold 1,500 finance books for $85 each to University of the West Indies (UWI) in 2019. These books cost Clarkesville $62 each to produce. In the marketing of the books, the Company paid $4,600 to a marketing firm, and it also borrowed $50,000 on January 1, 2019, on which the Company paid 10 percent interest. Both interest and principal are paid on December 21, 2019. Depreciation expense for the year was $8,000 and Clarksville’s tax rate is 25 percent. Verify whether Clarksville Printing Company made a profit in 2019, by presenting an income statement in good form. Explain the impact of the new loan of $50,000 and the depreciation expense on the cash flows. Determine the Operating Cash Flow for Clarksville Company. What accounts for the difference in the net income and the operating cash flow? As the Fund Manager for Bank of Trinidad and Tobago Limited, you are to advise the following two (2) clients based on their respective financial situations.…arrow_forwardHolly Springs, Incorporated contracted with Coldwater Corporation to have constructed a custom-made lathe. The machine was completed and ready for use on January 1, 2024. Holly Springs paid for the lathe by issuing a $330,000 note due in three years. Interest, specified at 2%, was payable annually on December 31 of each year. The cash market price of the lathe was unknown. It was determined by comparison with similar transactions for which 6% was a reasonable rate of interest. Holly Springs uses the effective interest method of amortization. Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Prepare the journal entry on January 1, 2024, for Holly Springs' purchase of the lathe. 2. Prepare an amortization schedule for the three-year term of the note. 3. Prepare the journal entries to record (a) interest for each of the three years and (b) payment of the note at maturity. Complete this question by…arrow_forward

- Holly Springs, Incorporated contracted with Coldwater Corporation to have constructed a custom-made lathe. The machine was completed and ready for use on January 1, 2024. Holly Springs paid for the lathe by issuing a $330,000 note due in three years. Interest, specified at 2%, was payable annually on December 31 of each year. The cash market price of the lathe was unknown. It was determined by comparison with similar transactions for which 6% was a reasonable rate of interest. Holly Springs uses the effective interest method of amortization. Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Prepare the journal entry on January 1, 2024, for Holly Springs' purchase of the lathe. 2. Prepare an amortization schedule for the three-year term of the note. 3. Prepare the journal entries to record (a) interest for each of the three years and (b) payment of the note at maturity. Complete this question by…arrow_forwardHolly Springs, Incorporated contracted with Coldwater Corporation to have constructed a custom-made lathe. The machine was completed and ready for use on January 1, 2024. Holly Springs paid for the lathe by issuing a $300,000 note due in three years. Interest, specified at 2%, was payable annually on December 31 of each year. The cash market price of the lathe was unknown. It was determined by comparison with similar transactions for which 6% was a reasonable rate of interest. Holly Springs uses the effective interest method of amortization. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required:1.Prepare the journal entry on January 1, 2024, for Holly Springs’ purchase of the lathe. 2.Prepare an amortization schedule for the three-year term of the note. 3.Prepare the journal entries to record (a) interest for each of the three years and (b) payment of the note at maturity.arrow_forwardBraxton Technologies, Inc. constructed a conveyor for A&G Warehousers that was completed and ready for use on January 1, 2016. A&G paid for the conveyor by issuing a $100,000, four-year bond that specified 5% interest to be paid on December 31 of each year, and the bond is to be repaid at the end of four years. The conveyor was custom-built for A&G, so its cash price was unknown. By comparison with similar transactions, it was determined that a reasonable interest rate was 10%. Required: 1. Prepare the journal entry for A&G's purchase of the conveyor on January 1, 2016. 2. Prepare an amortization schedule for the four-year term of the note. 3. Prepare the journal entry for A&G's third interest payment on December 31, 2018arrow_forward

- The following information applies to the questions displayed below.] Bailey Delivery Company, Inc., was organized in 2018 in Wisconsin. The following transactions occurred during the year: Received cash from investors in exchange for 12,000 shares of stock (par value of $1.00 per share) with a market value of $6 per share. Purchased land in Wisconsin for $25,000, signing a one-year note (ignore interest). Bought two used delivery trucks for operating purposes at the start of the year at a cost of $14,000 each; paid $3,000 cash and signed a note due in three years for the rest (ignore interest). Paid $1,900 cash to a truck repair shop for a new motor for one of the trucks. (Increase the account you used to record the purchase of the trucks because the productive life of the truck has been improved) Sold one-fourth of the land for $6,250 to Pablo Development Corporation, which signed a six-month note. Stockholder Helen Bailey paid $27,700 cash for a vacant lot (land) in Canada for her…arrow_forwardThe company completed the following transactions during 2020. • Jan 10 sold inventory to Natty Paul, $11,000, on account • May 15 wrote off as uncollectible the accounts of Terry Carter, $2,500 and Maggie Cube $400 • August 04 received 70% of the amount owed by Natty Paul and wrote off the remainder as uncollectible • October 26 received 30% of the funds owed from Maggie Cube as part payment of her account which had been written off earlier as uncollectible. • December 31, The Aging schedule showed an estimated $116,500 as uncollectible Requirements: 1. Prepare journal entries for each transaction (No narrations required) 2. Prepare the Allowance for Uncollectible and the Accounts Receivable accounts based on the information presented and balance off each account. 3. Prepare the balance sheet extract as at Dec 31, 2020, to show the net realizable value for the Accounts Receivable. 4. Assume credit sales for 2019 were $312,000 and that on December 31, 10% of credit sales are estimated…arrow_forwardThompson Limited, a private company with no published credit rating, completed several transactions during 2020. In January, the company bought under contract a machine at a total price of $1.46 million. It is payable over five years with instalments of $292,000 per year, with the first payment due January 1, 2020. The seller considered the transaction to be an instalment sale with the title transferring to Thompson at the time of the final payment. If the company had paid cash for the machine at the time of the sale, the machine would have cost $1,280,000. The company could have borrowed from the bank to buy the machine at an interest rate of 7%. It is expected that the machine will last 10 years. On July 1, 2020, Thompson issued $12.20 million of bonds priced at 99 with a coupon of 10% payable July 1 and January 1 of each of the next 10 years to a small group of large institutional investors. As a result, the bonds are closely held. The July 1 interest was paid and on December 30 the…arrow_forward

- The company completed the following transactions during 2020. • Jan 10 sold inventory to Natty Paul, $11,000, on account • May 15 wrote off as uncollectible the accounts of Terry Carter, $2,500 and Maggie Cube $400 • August 04 received 70% of the amount owed by Natty Paul and wrote off the remainder as uncollectible • October 26 received 30% of the funds owed from Maggie Cube as part payment of her account which had been written off earlier as uncollectible. • December 31, The Aging schedule showed an estimated $116,500 as uncollectible Requirements: 1. Prepare journal entries for each transaction (No narrations required) 2. Prepare the Allowance for Uncollectible and the Accounts Receivable accounts based on the information presented and balance off each account. 3. Prepare the balance sheet extract as at Dec 31, 2020, to show the net realizable value for the Accounts Receivable. 4. Assume credit sales for 2019 were $312,000 and that on December 31, 10% of credit…arrow_forwardHolly Springs, Inc. contracted with Coldwater Corporation to have constructed a custom-made lathe. The machine was completed and ready for use on January 1, 2021. Holly Springs paid for the lathe by issuing a $300,000 note due in three years. Interest, specified at 2%, was payable annually on December 31 of each year. The cash market price of the lathe was unknown. It was determined by comparison with similar transactions for which 6% was a reasonable rate of interest. Holly Springs uses the effective interest method of amortization. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1). (Use appropriate factor(s) from the tables provided.) Required:1. Prepare the journal entry on January 1, 2021, for Holly Springs’ purchase of the lathe.2. Prepare an amortization schedule for the three-year term of the note.3. Prepare the journal entries to record (a) interest for each of the three years and (b) payment of the note at maturity.arrow_forwardOn January 2, 2024, the Midwestern Steam Gas Corporation purchased an industrial furnace. In payment, Midwestern signed a noninterest - bearing note requiring $50,000 to be paid on December 31, 2025 (two years later). If Midwestern had borrowed cash to buy the furnace, the bank would have required an interest rate of 10% . Required: Record the journal entry for Midwestern for 1/2/2024, 12/31/2024, and 12/31/2025.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education