Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 11PC

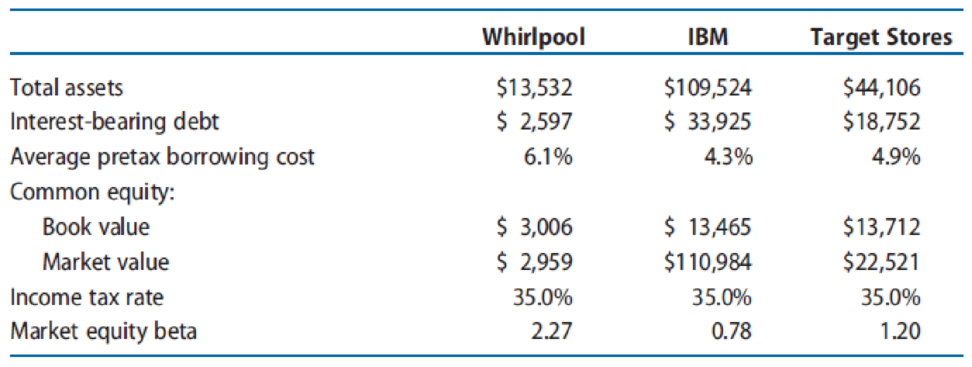

Whirlpool manufactures and sells home appliances under various brand names. IBM develops and manufactures computer hardware and offers related technology services. Target operates a chain of general merchandise discount retail stores. The data in the following table apply to these companies (dollar amounts in millions). For each firm, assume that the market value of the debt equals its book value.

REQUIRED

- a. Assume that the intermediate-term yields on U.S. government Treasury securities are 3.5%. Assume that the market risk premium is 5.0%. Compute the

cost of equity capital for each of the three companies. - b. Compute the weighted-average cost of capital for each of the three companies.

- c. Compute the unlevered market (asset) beta for each of the three companies.

- d. Assume that each company is a candidate for a potential leveraged buyout. The buyers intend to implement a capital structure that has 75% debt (with a pretax borrowing cost of 8.0%) and 25% common equity. Project the weighted-average cost of capital for each company based on the new capital structure. To what extent do these revised weighted-average costs of capital differ from those computed in Requirement b?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Sainsbury is financed by both debt and equity. Using the following information and calculate the weighted average cost of capital (WACC) of Sainsbury. (HINT)the average of recent yearly returns of FTSE100 as proxy of UK market is 7.5%; UK corporate tax rate is 19%).

Debt 748,000

Equity 6,604,000

Risk free rate 1.971%

Beta 0.27

Current Debt 258,000

Total liabilities and stockholders' equity 25,162,000

Which of the following has the highest interest rate?

Select one:

a. Corporate Bond

O b. Government Bond

c. Treasury Bills

d. Callable Corporate Bond

The ratio that is used to compare the market value between companies is

Select one:

a. Equity Muitiplier

b. EPS

c. P/E

d. Profit margin

You have 50,000BD which you can use to either buy cars or to deposit in a bank account for 1

year. Inflation for the year is estimated to be 7%, and the bank deposit rate is 4.5%.

if you had a goal of purchasing as many cars as possible, when should you buy them?

Select one:

a. Now

b. After a year

c. After 2 years

d. Not enough information to decide

ABC Company has a BB credit rating. Companies with similar credit ratings are currently paying a premium of 150 basis points (2.84%) above the yield on U.S. Treasury bonds of 2.25% p.a. on similar term bonds. The company faces a marginal tax rate of 31 percent. What would be the after-tax cost of debt used in calculating the company's weighted average cost of capital? Present your answer in percentage terms, rounded to two decimal places (e.g., 4.56%). Round your answer to 2 decimal places. Please show all work and how to set up in excel with formulas.

Chapter 11 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose that the assets of a bank consist of $100 million of loans of BBB-rated corporations. The PD for the corporations is estimated as 1%. The average maturity is five years and the LGD is 60%. What is the total risk-weighted assets for credit risk under the Basel II advanced IRB approach? Question 5Answer a. $178.1 million b. $13.2 million c. $165.4 million d. $100 millionarrow_forwardWhat is the difference in the interest rates on commercial paper for financial firms versus nonfinancial firms? Explain possible reasons for the difference. What is the most recent interest rate reported for, 1-year, 2-year, 5-year, 10-year, and 30-year maturity Treasuries? Provide the graph of the rates over the maturity (the yield curve) and interpret the shape of the yield curve. 2. The most famous financial market in the world is the New York Stock Exchange (NYSE). Visit the NYSE website and then answer the following questions: ● What is the mission of the NYSE? ● What would be the fee for a firm with five million common shares outstanding?arrow_forwardIn search of arbitrage profits in the forex market, you ring ANZ bank and Commonwealth bank. Both are Australia commercial bank. These two banks offer you the following quotes for the USD at the same time: MYR/USD 1.1650- 1.1670 UOB Bank HSBC Bank MYR/USD 1.1640- 1.1660 Illustrate your calculation start with RM1 million. Can you make an arbitrage profit with these quotes?arrow_forward

- Suppose an investment bank is buying $50 million in long-term mortgage-backed securities and finances the investment by borrowing 70% and paying for the other 30% out of equity. What is the bank's leverage ratio? a) 0.30 b) 0.13 c) 3/7 d) 3arrow_forward(Related to Checkpoint 4.1) (Liquidity analysis) Airspot Motors, Inc. has $2,499,800 in current assets and $862,000 in current liabilities. The company's managers want to increase the firm's inventory, which will be financed using short-term debt. How much can the firm increase its inventory without its current ratio falling below 2.2 (assuming all other current assets and current liabilities remain constant)? Airspot Motors, Inc. could add up to $ in inventories. (Round to the nearest dollar.)arrow_forwardHow would you interpret the Tier 1 Leverage Ratio for these 3 banks? What do these ratios mean? Bank A 8.37%; Bank B 10.70%; Bank C 10.57% 2. How would you interpret the Cost of Funds (CoF) for these 3 banks? What do these percentages mean? Bank A 21.32%; Bank B 7.21%; Bank C 123.89%arrow_forward

- Citigroup SmithBarney (Reais). In a report dated June 17, 2003, Citigroup SmithBarney calculated a WACC for Petrobrás denominated in Brazilian reais (R$). Evaluate the methodology and assumptions used in this cost of capital calculation. Risk-free rate (Brazilian C-Bond) Petrobrás levered beta Market risk premium Cost of equity Cost of debt Brazilian corporate tax rate Long-term debt ratio (% of capital) WACC (RS) 9.90% 1.40 5.50% 17.60% 10.00% 34.00% 50.60% 12.00%arrow_forwardSunrise Manufacturing, Inc. Sunrise Manufacturing, Ic., a U.S. multinational company, has the following debt components in its consolidated capital section, E. Sunrise's shareholders' equity is $40,000,000 and its finance staff estimates their cost of equity to be 20.0%. Current exchange rates are also listed in the table. Income taxes are 40% around the world after allowing for credits. Calculate Sunrise's weighted average cost of capital. Are any assumptions implicit in your calculation? What is Sunrise's weighted average cost of capital? % (Round to two decimal places.) - X Data table Assumption Value Tax rate 40% $10,000,000 25-year US$ bonds 5-year US$ bonds 10-year eurobonds (euros) $6,000,000 €9,000,000 20-year yen bonds (yen) Pre-tax cost of 25-year US$ bonds Pre-tax cost of 5-year US$ bonds Pre-tax cost of 10-year eurobonds Pre-tax cost of 20-year yen bonds Spot rate ($/€) Spot rate ($/£) Spot rate (¥/$) ¥800,000,000 7.5% 4.5% 6.0% 4.0% 1.2700 1.9200 107.00 Click on the icon…arrow_forward(Financing decisions) Brussels Electronics, Inc, has total assets of $64 million and total debt of $45 million. The company also has operating profits of $23 millions with interest expenses of $7 million. a. What is Brussels Electronic's debt ratio? b. What is Brussels Electronic's time interest earned? c. Based on the information above, would you recommend to Brussels Electron-ics's management that the firm is in a strong enough position to assume more debt and increase interest expense to $9 million?arrow_forward

- Binomial Tree Farm's financing includes $5 million of bank loans. Its common equity is shown in Binomial's Annual Report at $6.67 million. It has 500,000 shares of common stock outstanding, which trade on the Wichita Stock Exchange at $18 per share. What debt ratio should Binomial use to calculate its company cost of capital or asset beta? Note: Enter your answer as a percent rounded to 2 decimal places. Debt ratio %arrow_forwardThe liabilities and owners’ equity for Campbell Industries is found here. What percentage of the firm’s assets does the firm now finance using debt (liabilities)? If Campbell were to purchase a new warehouse for $1.4 million and finance it entirely with long-term debt, what would be the firm’s new debt ratio?arrow_forwardSuppose that the assets of a bank consist of $200 million of retail loans (not mortgages). The PD is 1% and the LGD is 70%. What is the risk-weighted assets under the Basel II IRB approach? What are the Tier 1 and Tier 2 capital requirements?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

What is WACC-Weighted average cost of capital; Author: Learn to invest;https://www.youtube.com/watch?v=0inqw9cCJnM;License: Standard YouTube License, CC-BY