1.

Compute the time interest earned for Company E.

1.

Explanation of Solution

Times interest earned ratio:

Times interest earned quantifies the number of times the earnings before interest and taxes can pay the interest expense.

Compute the time interest earned for Company E.

Therefore, time interest earned by Company E is 1.33.

2.

Compute the time interest earned for Company S.

2.

Explanation of Solution

Times interest earned ratio:

Times interest earned quantifies the number of times the earnings before interest and taxes can pay the interest expense.

Compute the time interest earned for Company S.

Therefore, time interest earned by Company S is 2.0.

3.

Identify the effect of increase in sales by 10%, on each company’s net income.

3.

Explanation of Solution

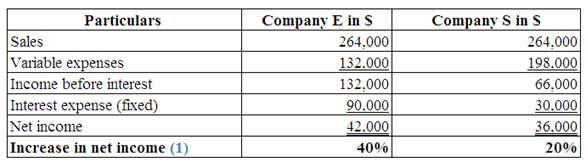

(Table 1)

Note:

Multiply the prior sales by 1.10

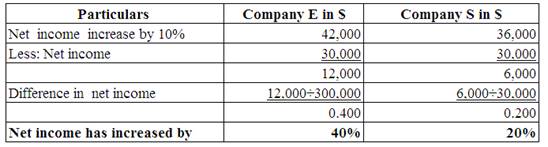

Working Note:

Calculate the increase in the value of net income.

(Table 2)

4.

Identify the effect of increase in sales by 40%, on each company’s net income.

4.

Explanation of Solution

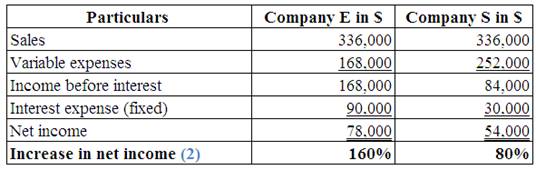

(Table 3)

Note:

Multiply the prior sales by 1.40

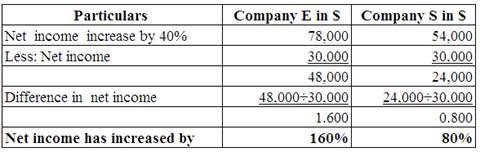

Working Note:

Calculate the increase in the value of net income.

(Table 4)

5.

Identify the effect of increase in sales by 90%, on each company’s net income.

5.

Explanation of Solution

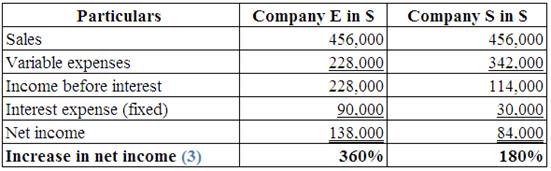

(Table 5)

Note:

Multiply the prior sales by 1.90

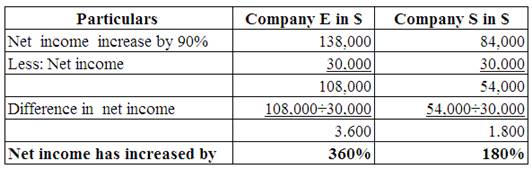

Working Note:

Calculate the increase in the value of net income.

(Table 6)

6.

Identify the effect of decreases in sales by 20%, on each company’s net income.

6.

Explanation of Solution

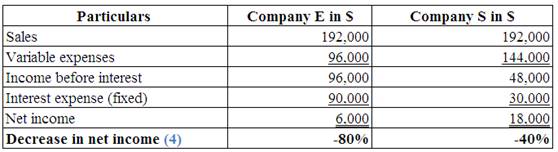

(Table 7)

Note:

Multiply the prior sales by 0.80

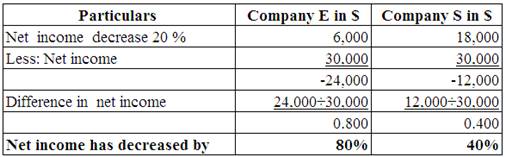

Working Note:

Calculate the increase in the value of net income.

(Table 8)

7.

Identify the effect of decreases in sales by 50%, on each company’s net income.

7.

Explanation of Solution

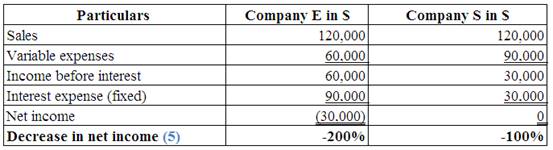

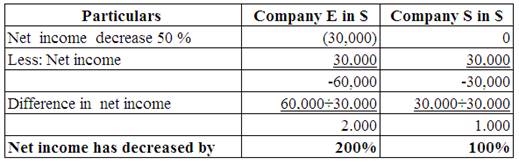

(Table 9)

Note:

Multiply the prior sales by 0.50

Working Note:

Calculate the increase in the value of net income.

(Table 10)

8.

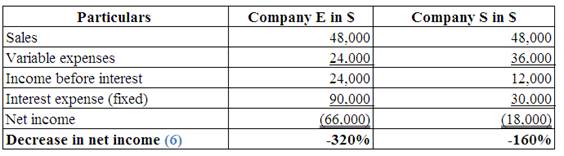

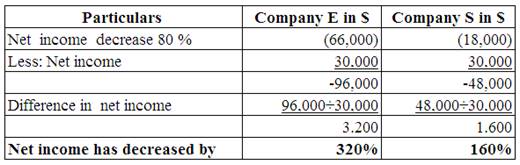

Identify the effect of decreases in sales by 80%, on each company’s net income.

8.

Explanation of Solution

(Table 11)

Note:

Multiply the prior sales by 0.20

Working Note:

Calculate the increase in the value of net income.

(Table 12)

9.

Comment on the results from requirement 3 through 8 in relation to the fixed-cost strategies of the two companies and the ratio values computed under requirement 1 and 2.

9.

Explanation of Solution

The higher fixed cost strategy of Company E shows the effect of increases and decreases in the value of sales. When sales increase, the value of net income increases. When sales decrease, the value of net income decreases. The higher fixed cost strategy of Company E is indicated by a lower value of the times interest earned ratio.

The higher fixed cost strategy works goods when there is increase in sales. Therefore, Company E enjoys has greater percent increases in the value of its net income. The Company is protected with the lower fixed cost strategy, when there is a decrease in sales level. Company S experiences smaller percent decreases in the value of net income because it has made this choice.

Want to see more full solutions like this?

Chapter 11 Solutions

Principles of Financial Accounting.

- The following amounts were reported by the two companies: Raiden Inc. Nash Company Net Total Income Assets Total Total Liabilities Revenues $42,000 $75,000 $40,000 $120,000 $55,000 $94,000 $60,000 $137,500 Required: Part a. Calculate each company's net profit margin expressed as a percent. Part b Which company has generated a greater return of profit from each revenue dollar? State what your answer is based on.arrow_forwardQuestion 2Alex is currently considering to invest his money in one of the companies between Company A and Company B. The summarized final accounts of the companies for their last completed financial year are as follows: a. Calculate the following ratios for Company A and Company B. State clearly the formulae used for each ratio: i. Gross Profit Marginii. Net Profit Marginiii. Inventory Turnover Period (days)iv. Receivables Collection Period (days)arrow_forwardRefer again to the income statements for Cover-to-Cover Company and Biblio Files Company on their respective Income Statement panels. Note that both companies have the same sales and net income. Answer questions (1) - (3) that follow, assuming that all data for the coming year is the same as the current year, except for the amount of sales. 1. If Cover-to-Cover Company wants to increase its profit by $20,000 in the coming year, what must their amount of sales be? 2. If Biblio Files Company wants to increase its profit by $20,000 in the coming year, what must their amount of sales be? 3. What would explain the difference between your answers for (1) and (2)? The answers are not different; each company has the same required sales amount for the coming year to achieve the desired target profit. The companies have goals that are not in the relevant range. Biblio Files Company has a higher contribution margin ratio, and so more of each sales dollar is…arrow_forward

- Consider the following income statement for the Heir Jordan Corporation: HEIR JORDAN CORPORATIONIncome Statement Sales $ 42,900 Costs 33,900 Taxable income $ 9,000 Taxes (21%) 1,890 Net income $ 7,110 Dividends $ 3,400 Addition to retained earnings 3,710 The balance sheet for the Heir Jordan Corporation follows. Based on this information and the income statement, supply the missing information using the percentage of sales approach. Assume that accounts payable vary with sales, whereas notes payable do not. (Leave no cells blank - be certain to enter "0" whenever the item is not a constant percentage of sales. Enter each answer as a percent rounded 2 decimal places, e.g., 32.16.) HEIR JORDAN CORPORATION Balance Sheet Percentage of Sales Percentage of Sales Assets…arrow_forwardAlex is currently considering to invest his money in one of the companies betweenCompany A and Company B. The summarized final accounts of the companies for theirlast completed financial year are as follows: (refer to the images) Required:a. Calculate the following ratios for Company A and Company B. State clearly theformulae used for each ratio:i. Gross Profit Marginii. Net Profit Marginiii. Inventory Turnover Period (days)iv. Receivables Collection Period (days)v. Payables Payment Period (days)vi. Current Ratiovii. Quick Ratiob. Comment on each of the ratios calculated in part (a) above.arrow_forwardRequired: Based on the information in the table below, prepare an income statement for Windswept Woodworks, Incorporated for year 2. Assume that the company pays a flat tax rate of 21% on its taxable income. (Round your answers to 2 decimal places.) Windswept Woodworks, Incorporated Input Data (millions of dollars) Accounts payable Accounts receivable Accumulated depreciation Cash & equivalents Common stock Cost of goods sold Depreciation expense Common stock dividends paid Interest expense Inventory Addition to retained earnings Long-term debt Notes payable Gross plant & equipment Retained earnings Sales Other current liabilities Tax rate Market price per share - year end Number of shares outstanding Windswept Woodworks, Incorporated Income Statement for the period ending December 31, Year 2 (millions of dollars) Sales Cost of goods sold Gross profit on sales Depreciation expense Earnings before interest and taxes Interest expense Taxable income Taxes (@21%) Net income Year 2 Year 1…arrow_forward

- Using Table 6–13, create a pro forma balance sheet using the percentage of sales method. If net income next year is $50,000, answer the following: How much did the owners take out of the business? What is the profit margin for next year?arrow_forwardCompute the component percentages for Trixy Magic's Income statement below. (Enter your answers as a percentage rounded to 2 decimal place (i.e. 0.1234 should be entered as 12.34). Enter all answers as positive values.) Net sales Cost of sales Gross margin Expenses Selling, general, and administrative Depreciation Interest-net Total expenses Pre-tax earnings Income tax provision Net earnings TRIXY MAGIC, INC. Consolidated Statements of Earnings (in millions) Fiscal 2018 $ $ 48,236 31,732 16,504 11,093 1,547 294 12,934 3,570 1,328 2,242 % Sales 100.00 % % Fiscal Years Ended on % Sales Fiscal 2017 $ $ 48,284 31,558 16,726 10,534 1,373 201 12,108 4,618 1,719 2,899 100.00 % % Fiscal 2016 % Sales S 46,930 30.741 16,198 ३ 9,746 1,171 156 11,073 5,125 1,910 3.215 100.00 %arrow_forwardWhat is companies net income? The following information is given to you relating to the operations of PrincehallCorporation: The income tax rate is 40%. Net sales $11,862 Cost of sales 8,321 Gross margin ? Selling, general, and administrative expenses $ 2,743 Depreciation, amortization, and asset write-offs 278 Total operating expenses: ? Income from operations : ? Interest expense 91 Interest and other income 11 Earnings before income taxes: ? Income taxes ? Net earnings: ? Determine the nest income of the company.arrow_forward

- Refer to the following selected financial information from Gomez Electronics. Compute the company's times interest earned for Year 2. Net sales. Cost of goods sold Interest expense Net income before tax Net income after tax Total assets Total liabilities Total equity Multiple Choice O O O O 4.5. 5.5. 7.6. 13.6. 6.6. Year 2 $ 481,500 276,900 10,300 67,850 46,650 318,300 178,400 139,900 Year 1 $ 426,850 250, 720 11,300 53,280 40,500 291,600 167,900 123,700arrow_forwardIf the following financial information related to XYZ Company. Total Revenues last year $870, depreciation expenses $40, costs of goods sold $350, and interest expenses $50. At the end of the year, current assets were $100 and current liabilities were $105. The company has an average tax rate of 30%. Calculate the net income for XYZ Company by setting up an income statement.arrow_forwardWhat is the difference between operating income, net income and other comprehensive income? If a company has a revenue of 2.2million and operating income of $120,000. Does the company has a high operating income margin?arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning