Contemporary Engineering Economics (6th Edition)

6th Edition

ISBN: 9780134105598

Author: Chan S. Park

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 2P

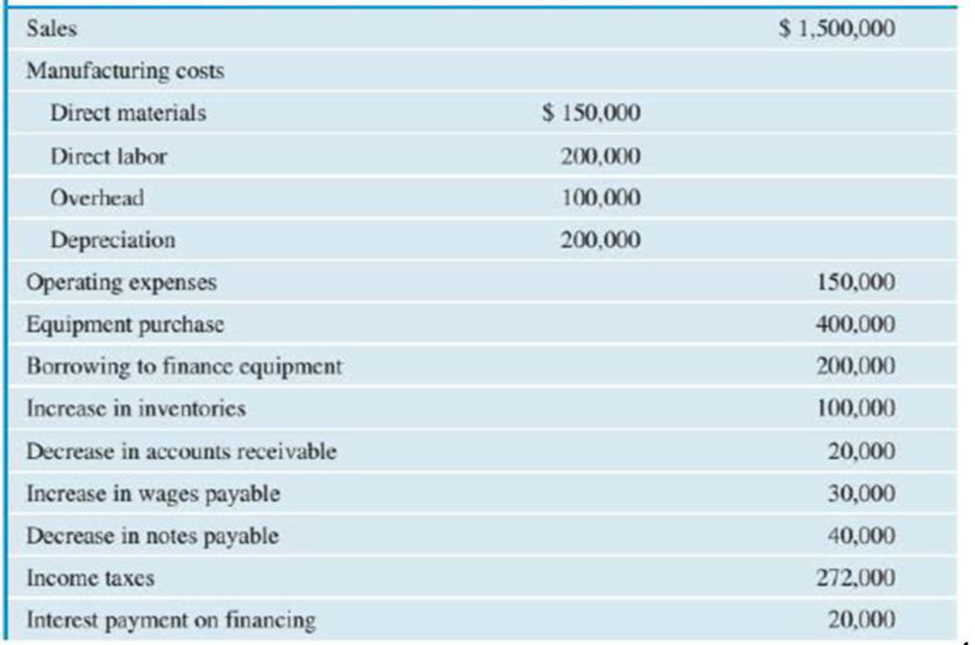

A chemical processing firm is planning on adding a duplicate polyethylene plant at another location. The financial information for the first project year is shown in Table P2.2.

- (a) Compute the working-capital requirement during the project period.

- (b) What is the taxable income during the project period?

- (c) What is the net income during the project period?

- (d) Compute the net cash flow from the project during the first year.

TABLE P2.2 Financial Information for First Project Year

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

smallville is suffering annual losses of taxable properties and property values of 1% each. Even so, Smallville must maintain its tax collections at a constant value of $3.2 million to maintain services. What is the required rate of increase in the tax rate? NOTE: While smallville uses a rate of 6% for the time value of money, that rate is irrelevant to this problem.

Note:-

Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

Answer completely.

You will get up vote for sure.

A commercial investment property was purchased for $22,000,000. The property's net lettable area is 3,200 m2. The property is operating at a stabilised occupancy of 90.0%. The leases are gross and the annual base rent in the first year is $590 per m2. The rent is reviewed annually and increased at a fixed rate of 2.00%. The building doesn't generate any miscellaneous income. The fixed OPEX are $75 per m2 and variable OPEX are $90 per m2 in the first year. The annual OPEX inflation is 4.50%. The property is purchased with 60.00% in debt financing with a fully amortising loan for a term of 20 years, monthly payments and an annual interest rate of 5.65%. Calculate Year 3 Equity Dividend Rate. Enter your answer without the % sign rounded to two decimal places

If the incremental federal income tax rate is 34% and the incremental state income tax rate is 6%, what is the effective combined income tax rate (t)? If state income taxes are 12% of taxable income, what now is the value of t?

Chapter 2 Solutions

Contemporary Engineering Economics (6th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 2- A rough rule of thumb for the chemical industry is that OMR 1 of annual sales required OMR 2 of fixed capital investment. In a chemical processing plant where this rule applies, the total capital investment is OMR 3200000 and the working capital is 18% of the total capital investment. The annual net total product cost amounts to 1500000 OMR. If the income tax rates on gross earnings total 21%, determine the following: (a) Percent of total capital investment returned annually as gross earning. (b) Percent of total capital investment returned annually as net profit.arrow_forwardInvestment - End of Chapter Problem Management at TJX Companies is deciding whether to build a new goods distribution center. The distribution center will cost $60 million to build; the estimated additional first year revenue will be $5 million. The distribution center will last 50 years, with a depreciation rate of 5% per year. The opportunity cost of this investment is predicted to be 7% interest earned. a. What is the present value of the stream of payments resulting from this potential new goods distribution center? Round to the nearest million. $ b. TJX million build the distribution center because the benefit exceeds the cost cost exceeds the benefitarrow_forwardInvestment-End of Chapter Problem Management at TJX Companies is deciding whether to build a new goods distribution center. The distribution center will cost $60 million to build; the estimated additional first year revenue will be $5 million. The distribution center will last 50 years, with a depreciation rate of 5% per year. The opportunity cost of this investment is predicted to be 7% interest earned. a. What is the present value of the stream of payments resulting from this potential new goods distribution center? Round to the nearest million. $ b. TJX million build the distribution center because thearrow_forward

- Omar Shipping Company bought a tugboat for $75,000 (year 0) and expected to use it for five years after which it will be sold for $12,000. Suppose the company estimates the following revenues and expenses from the tugboat investment for the first operating year: If the company pays taxes at the rate of 30% on its taxable income, what is the net income during the first year? (a) $28,700(b)$81,200(c) $78,400(d) $25,900arrow_forwardInvestment- -End of Chapter Problem Management at TJX Companies is deciding whether to build a new goods distribution center. The distribution center will cost $60 million to build; the estimated additional first year revenue will be $5 million. The distribution center will last 50 years, with a depreciation rate of 5% per year. The opportunity cost of this investment is predicted to be 7% interest earned. a. What is the present value of the stream of payments resulting from this potential new goods distribution center? Round to the nearest million. b. TJX million. build the distribution center because thearrow_forwardArlington Company is constructing a building. Construction began on January 1 and was completed on December 31. Expenditures were $4,000,000 on March $3,300,000 on June 1, and $5,000,000 on December 31. Arlington Company borrowed $2,000,000 on January 1 on a 5-year, 12% note to help finance construction of the building. In addition, the company had outstanding all year a 10%, 3-year, $4,000,000 note payable and an 11%, 4-year, $7,500,000 note payable. What is the weighted-average interest rate used for interest capitalization purposes? (Round two decimal places) 11% 10.85% Ο 10.5% Ο 10.65%arrow_forward

- 11) What is the present worth of an independent project that requires initial investment of $50 000 and annual maintenance costs of $4 000 for 10 years at a 4% minimum acceptable rate of return? A) -$4 000 B) -$32 444 C) -$54 000 D) -$82 444 E) -$17 556arrow_forwardThe tables to the right show recent state income tax (A) Write a piecewise definition for the tax due T(x) on an income of x dollars for an individual. if 0≤x≤ 15,000 if 15,000 < x≤ 30,000 if 30,000arrow_forwardLast year aria left her job earning $82,000 per year in order to start her own cupcake business Her expenses included rent of $1,500 per month, as well as $500 per month in supplies and utilities. She hired two workers at $1000 per month for each. She didn't want to rent a professional oven so she purchased one for $6500, She expects it to depreciate at the rate of $900 per year . Over the course of the year, Aria sold 125,000 cupcakes with a revenue of $125,000 Aria is business savvy and knows she must control her costs in this market with so many firms, easy entry and identical products. Therefore she will only operate at her profit-maximizing or loss-minimizing level of output Total explicit costs for the year are Total implicit costs for the year are Total fixed costs for the year are Total variable costs for the year are Average total costs for the year are Total accounting costs for the year are Total economic costs for the year are Since you can't draw it,…arrow_forwardLast year aria left her job earning $82,000 per year in order to start her own cupcake business Her expenses included rent of $1,500 per month, as well as $500 per month in supplies and utilities. She hired two workers at $1000 per month for each. She didn't want to rent a professional oven so she purchased one for $6500, She expects it to depreciate at the rate of $900 per year . Over the course of the year, Aria sold 125,000 cupcakes with a revenue of $125,000 Aria is business savvy and knows she must control her costs in this market with so many firms, easy entry and identical products. Therefore she will only operate at her profit-maximizing or loss-minimizing level of output Since you can't draw it, briefly describe how her mr curve looks and where you would draw it What price will she charge Is she earning profit? If so, how much? If not, should she shut down? Why or why not?arrow_forwardLast year aria left her job earning $82,000 per year in order to start her own cupcake business Her expenses included rent of $1,500 per month, as well as $500 per month in supplies and utilities. She hired two workers at $1000 per month for each. She didn't want to rent a professional oven so she purchased one for $6500, She expects it to depreciate at the rate of $900 per year . Over the course of the year, Aria sold 125,000 cupcakes with a revenue of $125,000 Aria is business savvy and knows she must control her costs in this market with so many firms, easy entry and identical products. Therefore she will only operate at her profit-maximizing or loss-minimizing level of output Total explicit costs for the year are Total implicit costs for the year are Total fixed costs for the year are Total variable costs for the year are Average total costs for the year are Total accounting costs for the year are Total economic costs for the year are Since you can't draw it,…arrow_forwardLast year aria left her job earning $82,000 per year in order to start her own cupcake business Her expenses included rent of $1,500 per month, as well as $500 per month in supplies and utilities. She hired two workers at $1000 per month for each. She didn't want to rent a professional oven so she purchased one for $6500, She expects it to depreciate at the rate of $900 per year . Over the course of the year, Aria sold 125,000 cupcakes with a revenue of $125,000 Aria is business savvy and knows she must control her costs in this market with so many firms, easy entry and identical products. Therefore she will only operate at her profit-maximizing or loss-minimizing level of output Total economic costs for the year are Since you can't draw it, briefly describe how her demand curve looks. Since you can't draw it, briefly describe how her mr curve looks and where you would draw it What price will she charge Is she earning profit? If so, how much? If not, should she shut down? Why…arrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

DATA GEMS: How to Access Income Data Tables and Reports From the CPS ASEC; Author: U.S. Census Bureau;https://www.youtube.com/watch?v=BWpVC-Clczw;License: Standard Youtube License